Smart wealth app

AI-Powered

Wealth Builder

for Canadians

No budgeting. No spreadsheets. Just smarter money moves that grow your wealth automatically.

1.avif)

How Finly Works

A Smarter Way to Build Wealth—Automated, Structured, and Easy.

Most people struggle with investing, saving, and planning for the future. Finly does it for you — you never have to wonder if you're making the right moves.

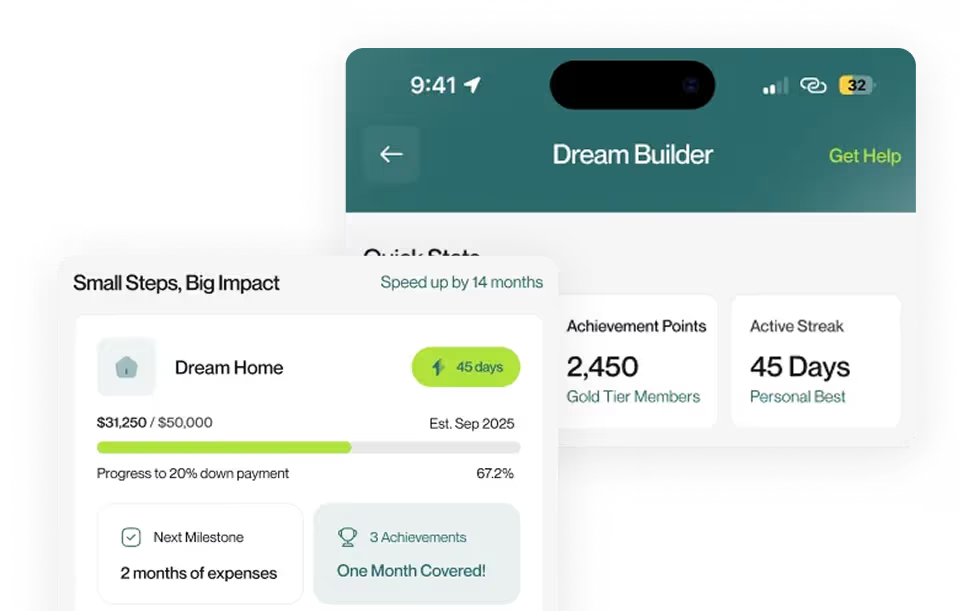

Step one

AI Builds Your Personalized Wealth Plan

Finly AI can help analyze your income, spending habits, and investments, & make a personalized wealth plan for you.

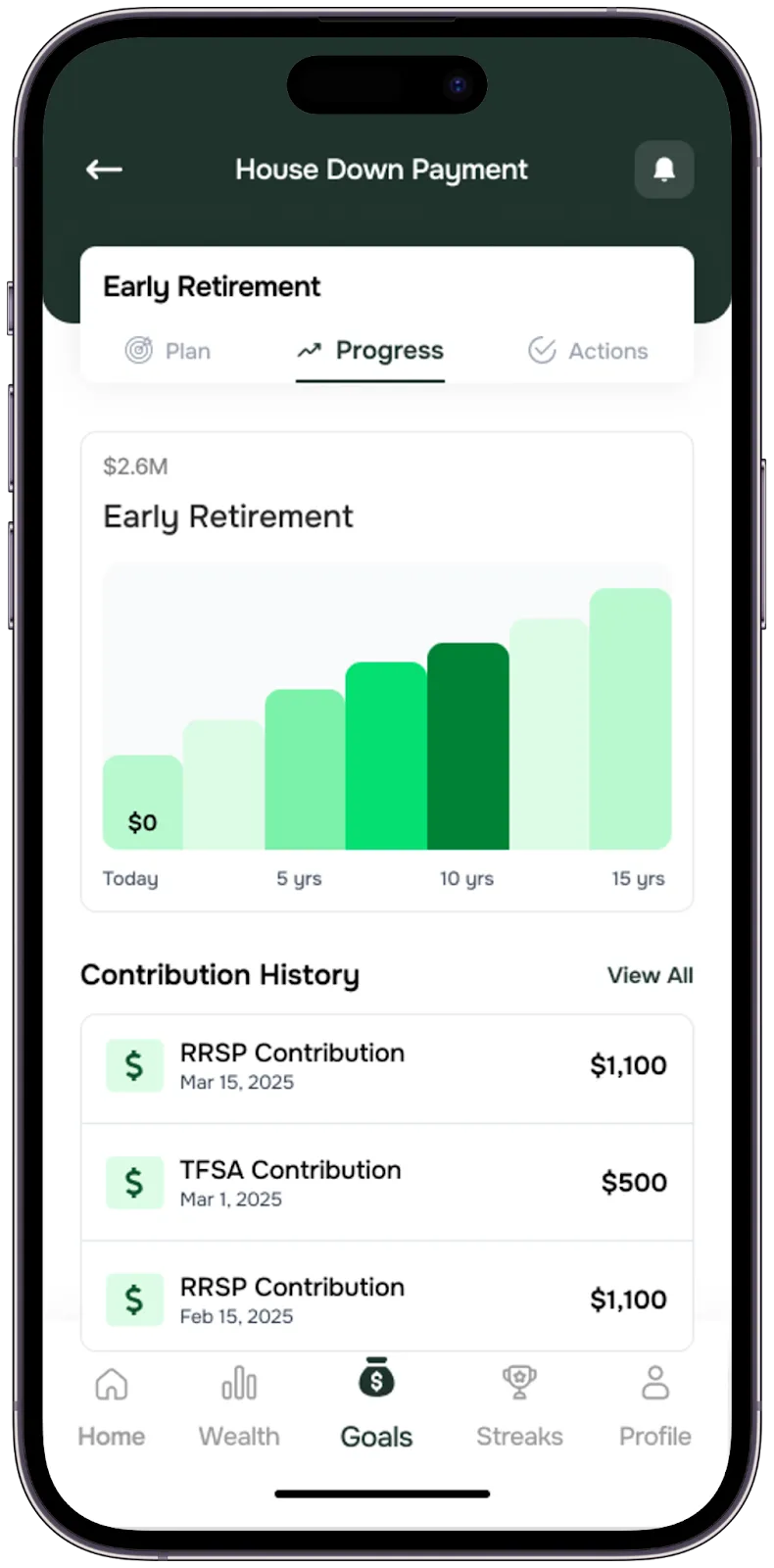

Step Two

Automated Investing & Smart Savings Contributions

Finly automatically suggests you to allocate funds to investments and savings accounts (TFSA, RRSP, high-yield savings).

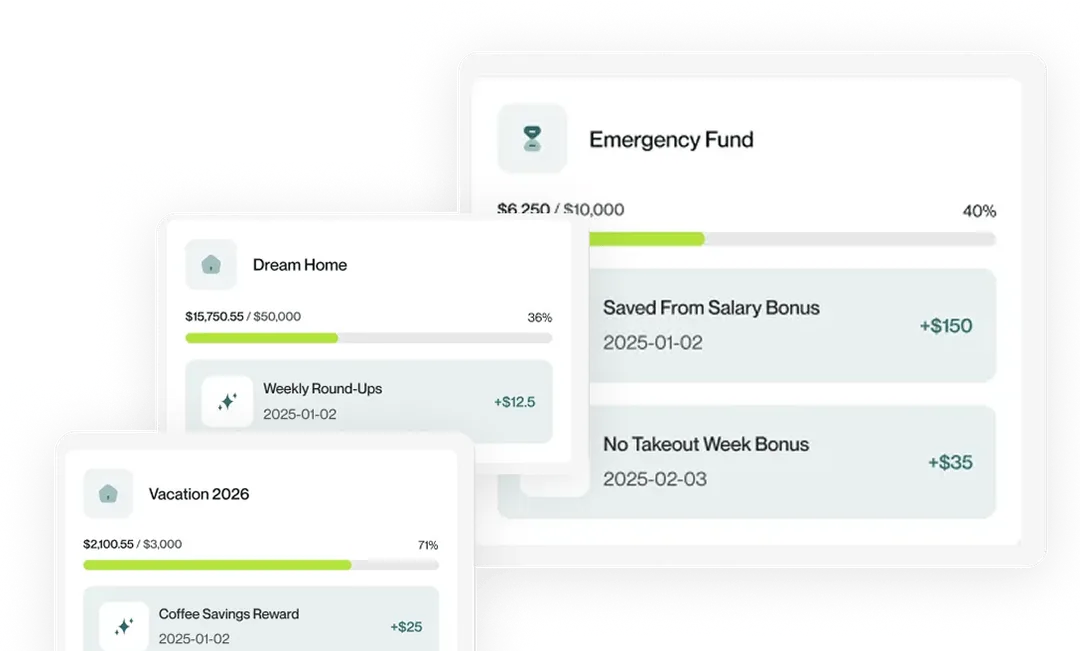

Step Three

AI-Optimized Tax Savings & Cash Flow Planning

Finly automatically optimizes your RRSP and TFSA contributions to reduce your taxes.

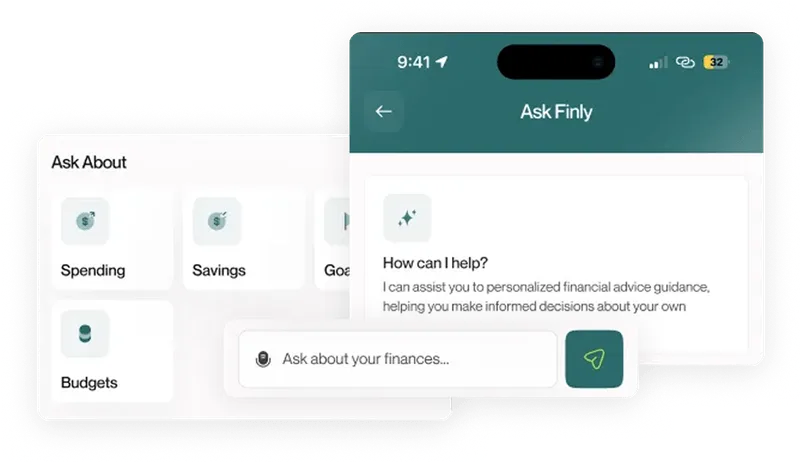

Step Four

Stay on Track with Smart AI Nudges & Insights

Ask Finly anything about your personal finance, goals, investing, doubts and questions, it’s here 24/7 and personalized for you

How Finly Works

More Than a Budgeting App. Smarter Than a Bank.

Finly automates your savings, investments, and tax planning—so you can focus on life.

Get Started with Finly

Feature

Traditional banks

Budgeting Apps

Finly (Al Wealth Builder)

Wealth Planning

Automated Investing

RRSP & TFSA Tax Optimization

Wealth Planning

Smart wealth app

Your Future Wealth Starts Now

Join thousands of Canadians using AI to build wealth automatically

.avif)

.avif)